On December 13, 2024, an expanded session of the multi-stakeholder working platform for improving NGO financial sustainability was held at the Armenian Lawyers Association (ALA) central office within the framework of the “Comprehensive Promotion of NGO Financial Sustainability in Armenia” project.

The discussion was opened by ALA President Karen Zadoyan and Anna Avagyan, Deputy Director of the “Active Civil Society” program implemented by Counterpart International and Urban Foundation for Sustainable Development. They welcomed the participants, emphasizing the significance of the meeting.

In his speech, the ALA President specifically emphasized that regardless of the project’s further progress, the parties should remain consistent in maintaining constructive dialogue. Zadoyan highlighted the importance of the in-depth analysis conducted to ensure the sustainability of Armenian NGOs, suggesting to evaluate its effectiveness and potential impact on state institutions. According to him, the main purpose of the discussion should be establishing mutual trust and finding common ground.

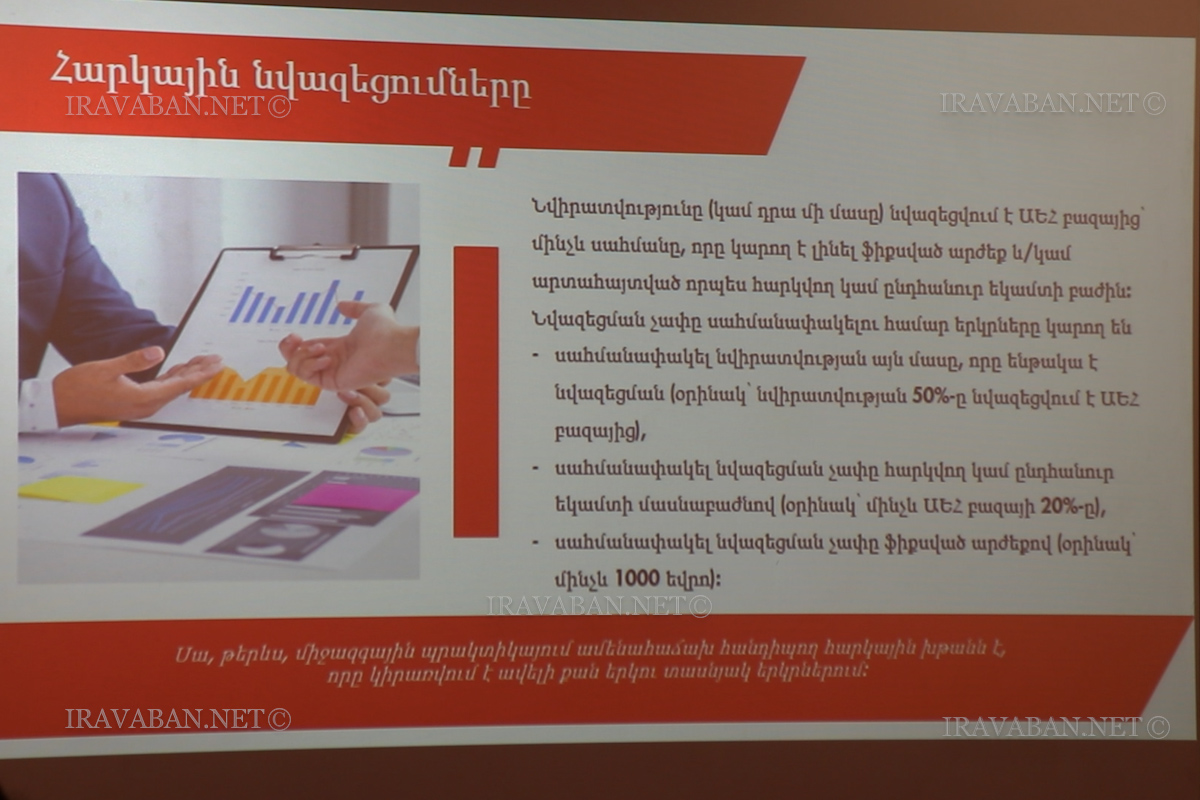

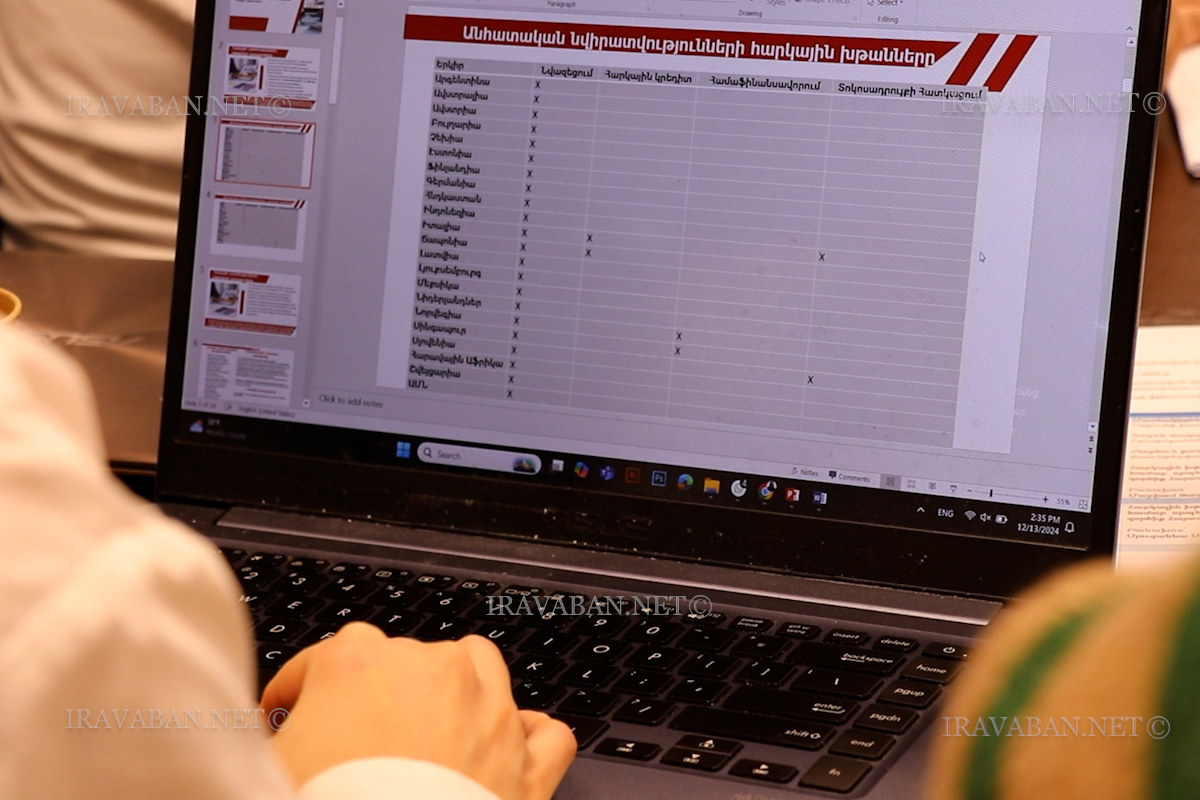

Expert speaker Syuzanna Soghomonyan identified four main mechanisms of tax incentives provided to NGOs, noting their different manifestations across various countries.

“The income tax allocation mechanism involves making certain percentage allocations from personal income tax rates. The allocation procedure is implemented through different principles in different countries. Legal regulations also vary depending on the country. These include tax legislation (Moldova, Slovakia) and sectoral laws on ‘Public Benefit Organizations’ (Poland), ‘Charity and Support’ (Lithuania), and ‘Non-Commercial Organizations’ (Moldova). Sub-legislative acts define the procedures for implementing allocations and reporting formats. Allocation rates in different countries range from 0.5% to 3.5%,” the expert noted.

According to Syuzanna Soghomonyan, the study of international experience shows significant differences in NGO financial sustainability indicators. For example, Lithuania and Moldova have seen improvements in sustainability, while in Armenia, NGO financial sustainability has remained unchanged, still requiring development.

The speaker emphasized that NGO sustainability in Armenia remains at a low level and requires additional attention and development.

Project expert Mariam Zadoyan also discussed tax credits: “The peculiarity of tax credits is that individuals can deduct all or part of their donation value directly from their tax liability. The credit value does not depend on the donor’s personal income tax rate. If the credit value exceeds the individual’s tax liability, it should be refundable. The gross donation mechanism allows individuals to authorize public benefit organizations to claim and receive a refund of the basic tax rate paid in connection with the donation.”

Mariam Zadoyan also presented the application of tax incentives for corporate philanthropy. According to her, countries can apply different approaches when implementing tax incentives. In international practice, tax deductions are the most common tax incentive, used in more than twenty countries.

The experts’ main recommendation concerns the implementation of an income tax percentage allocation mechanism in Armenia. This model’s key advantage is that the taxpayer bears no additional financial burden, it is implemented at zero cost, and the taxpayer can directly support organizations of interest.

Lernik Harutyunyan, Head of the Methodology and Procedures Department at the State Revenue Committee, noted that certain privileges already exist for NGOs, allowing them to apply to the state and receive VAT support. Harutyunyan also emphasized that if individuals are given a choice, they will choose not what is most important but what they like. In his opinion, it is necessary first to see what opportunities the state has and then think about what can be done.

Karen Zadoyan emphasized that discussions must start somewhere: “NGOs must be independent, should not be dependent on anything, and should not allow any influence on them.”

The meeting was also attended by Lilya Afrikyan, representative of the Prime Minister’s Office; Armen Grigoryan, representative of the Ministry of Economy; Harutyun Khudgaryan, representative of the RA Ministry of Justice; Gevorg Simonyan, representative of “Social Justice” NGO; Gayane Salnazaryan, representative of “Compass” consulting organization; Armen Baghdasaryan, Development Director of “Digital Armenia” NGO; Anush Martirosyan, representative of “Media for Education” NGO; Hakob Avagyan, representative of SME Association; Armen Petrosyan, tax expert; Hovsep Khurshudyan, representative of “Free Citizen” NGO; Lilit Yegoryan, representative of the Republican Union of Employers of Armenia; Movses Aristakesyan and Nune Arabachyan, representatives of “Economic Law Center” NGO; Satik Badeyan and Martin Badeyan, representatives of “Regional Development and Research Center” NGO; Anahit Mardoyan, Project Events Coordinator; Marianna Avagyan, lawyer at Armenian Lawyers Association; and Artak Saribekyan, Executive Director of Armenian Lawyers Association.

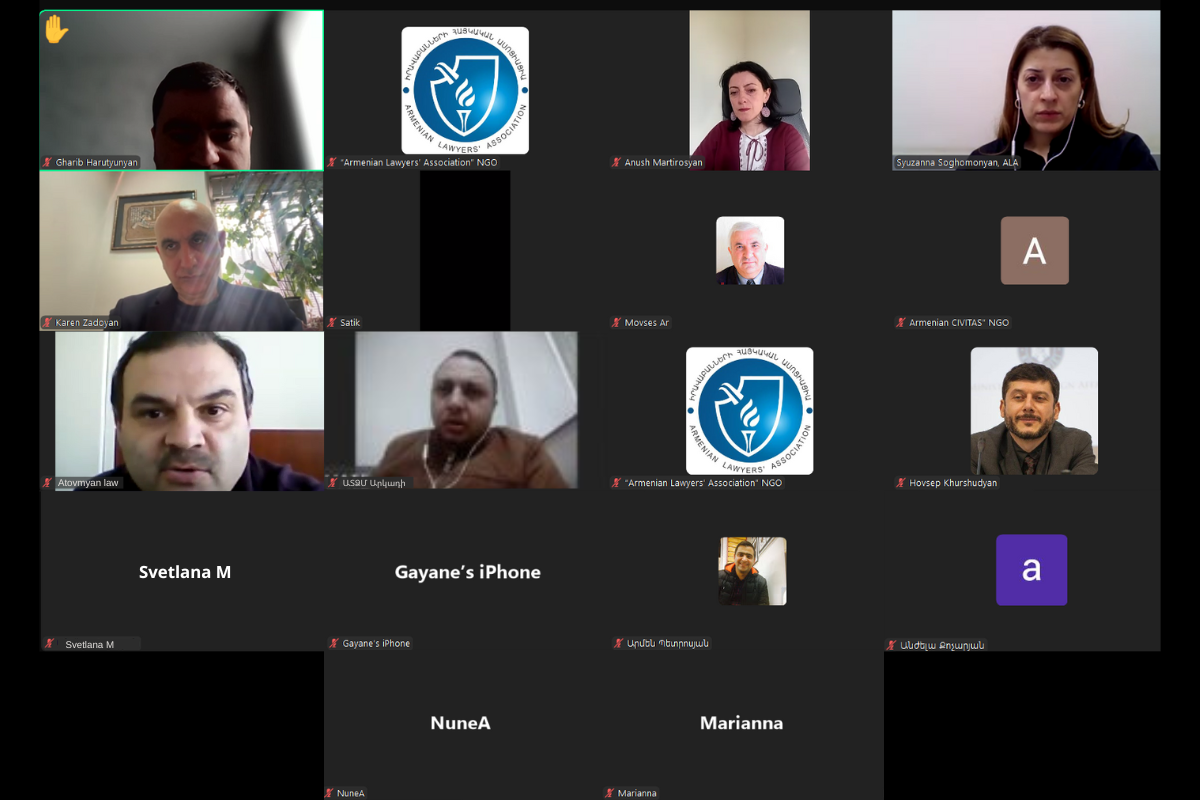

It should also be noted that on December 11, prior to this discussion, ALA organized an online session with the participation of NGO and business sector representatives within the framework of the Project. During the meeting, necessary steps towards ensuring NGO sustainability were presented, along with international experience of these tools, lessons learned and successes, discussing their implementation possibilities and directions in Armenia. Participants were also presented with the study “Application of Tax Incentives for Individual Donations as a Tool for Improving NGO Financial Sustainability in Armenia” and its main conclusions.

The meeting particularly emphasized the development of an individual donation culture, where private companies play a key role. The latter can serve as examples by encouraging their employees to make income tax allocations. Private sector representatives noted the need to promote active business involvement in social initiatives and create favorable conditions for cooperation. In this context, the introduction of tax incentives is particularly important, which can significantly contribute to increasing donations from private sector individuals to NGOs and establishing sustainable cooperation.

It should be noted that another discussion of the “Comprehensive Promotion of NGO Financial Sustainability in Armenia” project took place on November 11. The session was attended by Mariam Zadoyan, Armenian Lawyers Association NGO representative and project expert; Piruze Manukyan, representative of the “Active Civil Society” program; Lernik Harutyunyan, Head of the Administration Methodology and Procedures Department at the State Revenue Committee; Ori Alaverdyan, Head of the Revenue Policy and Administration Methodology Department at the Ministry of Finance; Satik Badeyan, representative of the “Regional Development and Research Center” NGO; Anahit Mardoyan, Project Events Coordinator; Artak Saribekyan, Executive Director of the Armenian Lawyers Association; and Marianna Avagyan, lawyer at the Armenian Lawyers Association.

Armenian Lawyers Association expert Mariam Zadoyan presented an analysis of international experience regarding tax incentives for civil society organization (CSO) financing.

Four main international mechanisms for encouraging NGO donations were identified: tax deductions, social expense reimbursements, gross donation and matching schemes, as well as income tax rate allocations.

“The study showed that different countries apply various incentive methods depending on the type and size of donations. The speaker noted that some countries implement more than one scheme. For example, in Italy, Portugal, and Slovakia, not only percentage allocations from income tax rates are in effect but also tax deductions. In Italy’s case, even three schemes are operating,” – the speaker also presented the specificities of each scheme.

This article was made possible through the generous support of the American people through the United States Agency for International Development (USAID). The content is the responsibility of the Armenian Lawyers Association, a sub-grantee of Counterpart International, and does not necessarily reflect the views of USAID, the United States Government, or Counterpart International.