This article is the first in the series “Innovative Financing Mechanisms for Civil Society Organizations (CSOs)”. The series is implemented within the framework of the “Strong Civil Society” program with the financial support of the United States Agency for International Development (USAID). The aim of the series is to study and present effective models of CSO financing, raise public awareness on this issue, and contribute to the development of civil society in Armenia. This article has been prepared by thoroughly studying the experience of implementing the 1% income tax mechanism in Eastern European countries. It aims to present the main principles, advantages and challenges of the mechanism based on the experience of these countries, and discuss its possible application in Armenia. Subsequent articles will discuss the details of implementing this mechanism, its possible impact on the CSO field in Armenia, as well as present more detailed analyses of international experience.

- Introduction

1.1 Terminology and definitions:

CSO (Civil Society Organization) – A voluntarily formed organization, independent from the state and market, which pursues non-commercial purposes and operates for the benefit of the public or its members. The term CSO is not directly defined in Armenian legislation, but it coincides with the definition of non-commercial organizations given in the Civil Code. According to Article 51, Part 1 of the Civil Code: “Legal entities can be organizations that pursue profit-making purposes through their activities (commercial) or organizations that do not pursue profit-making purposes and do not distribute the received profit among participants (non-commercial)”.

Organizational forms of CSOs in Armenia:

According to Article 51, Part 4 of the RA Civil Code, “Legal entities considered non-commercial organizations can be created in the form of public associations, foundations or other forms provided by law”. However, one reservation: for an organization to be considered a CSO, in addition to being non-commercial, it must also be non-governmental. The organizational forms of CSOs in Armenia are:

- Public associations,

- Foundations,

- Other forms provided by law.

Terms used in Eastern European countries:

- Hungary – “Civil szervezet” (Civil organization),

- Slovakia – “Mimovládna organizácia” (Non-governmental organization),

- Romania – “Organizație neguvernamentală” (Non-governmental organization),

- Poland – “Organizacja pozarządowa” (Non-governmental organization),

- Lithuania – “Nevyriausybinė organizacija” (Non-governmental organization),

- Moldova – “Organizație necomercială” (Non-commercial organization).

1.2 The role of CSOs in Armenia and financing challenges: Main areas of CSO activity in Armenia:

- human rights protection,

- judicial and anti-corruption fight,

- education and science,

- social services,

- youth issues,

- culture and art,

- public policy development and monitoring,

- environmental protection.

Current sources of funding and their limitations:

- international donor organizations: o advantage: large-scale funding, o limitation: dependence on external agenda,

- state grants: o advantage: solving local problems, o limitation: limited volumes, possible political influence,

- individual donations: o advantage: independence, o limitation: unstable and small volumes,

- entrepreneurial activity: o advantage: stable income, o limitation: possible deviation from the main mission.

The need for sustainable funding:

- opportunity to implement long-term programs,

- ensuring independence,

- maintenance and development of professional staff,

- development of organizational capacities.

1.3 The main idea of the 1% mechanism: The essence and purpose of the mechanism: The 1% mechanism allows taxpayers to direct a certain part (usually 1-2%) of their paid income tax to CSOs of their choice. The main objectives of the mechanism are:

- ensuring financial stability of CSOs,

- promoting civic participation,

- strengthening the state-CSO-citizen connection.

The main principles of applying the mechanism:

- voluntariness – the taxpayer decides whether to use the mechanism or not,

- freedom of choice – the taxpayer is free to choose the beneficiary CSO,

- confidentiality – the CSO does not know who directed the money to it,

- simplicity – the process should be understandable and easy to implement,

- transparency – clear accountability regarding the use of funds.

The potential impact of the mechanism on CSOs and society:

- increase in financial independence of CSOs,

- increase in citizen engagement in social processes,

- increase in competition and efficiency of CSOs,

- increase in public trust towards CSOs,

- promotion of social innovations.

1.4 The role of citizens and the importance of participation: The significance of an active civic position:

- strengthening democracy,

- effective solution of social problems,

- influence on public policy,

- effective use of public resources.

Forms of citizen participation in supporting CSOs:

- financial support (donations, 1% mechanism),

- volunteer work,

- provision of professional experience and knowledge,

- participation in CSO events,

- dissemination of information and raising awareness.

The image symbolizes the CSO ecosystem.

- International Experience

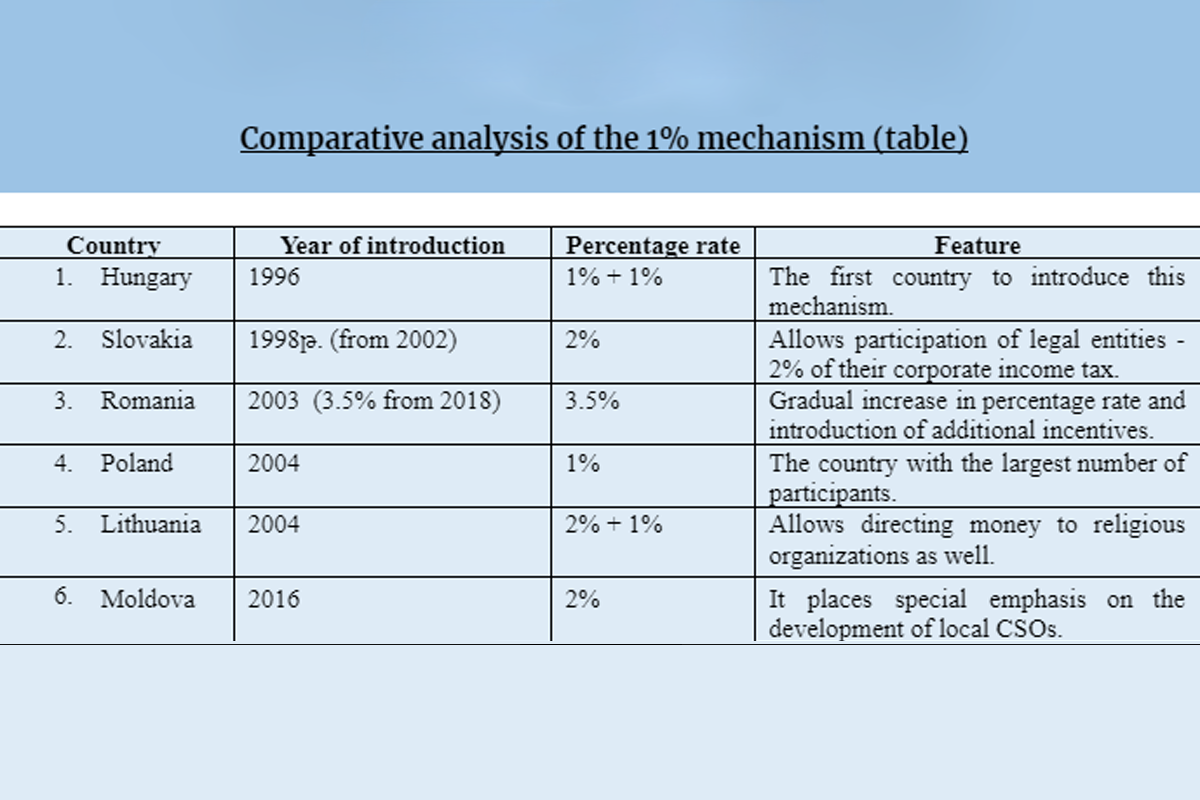

2.1 The origin and spread of the 1% mechanism in Eastern Europe:

The 1% mechanism was first introduced in Hungary in 1996. It quickly spread to other Eastern European countries as an innovative and effective model for CSO financing.

2.2 Examples from Eastern European countries:

2.2.1 Hungary

- year of introduction: 1996,

- percentage rate: 1% + 1% (for religious organizations),

- feature: the first country to introduce this mechanism,

2.2.2 Slovakia

- year of introduction: 1999 (2% in 2002),

- percentage rate: 2%,

- feature: also allows participation of legal entities – 2% of their corporate income tax,

2.2.3 Romania

- year of introduction: 2003 (2% in 2004, 3.5% in 2018)

- percentage rate: 3.5%

- feature: gradual increase in percentage rate and introduction of additional incentives,

2.2.4 Poland

- year of introduction: 2004,

- percentage rate: 1%

- feature: the country with the largest number of participants,

2.2.5 Lithuania

- year of introduction: 2004,

- percentage rate: 2% + 1% (for religious organizations),

- feature: allows directing money to religious organizations as well,

2.2.6 Moldova

- year of introduction: 2016,

- percentage rate: 2%,

- feature: it places special emphasis on the development of local CSOs:

Differences in the range of beneficiaries:

- in all countries: CSOs,

- in some countries: religious organizations (Hungary, Lithuania),

- in Slovakia: legal entities can also participate by deducting from their corporate income tax.

Comparative analysis of legal and administrative requirements:

- registration requirements: in all countries, CSOs must be registered in a special registry, accountability: mandatory annual reports in all countries,

- activity restrictions: political activity is generally prohibited.

2.4 Comparative analysis image:

- Advantages of the 1% mechanism: 3.1 Financial stability for CSOs:

- predictable and stable source of funding,

- opportunity to plan long-term programs,

- increased independence from donors and the state.

3.2 Promotion of civic participation:

- direct citizen involvement in supporting CSOs,

- increased public awareness about CSO activities,

- increased sense of civic responsibility.

3.3 Increased accountability of CSOs:

- increased competition among CSOs,

- increased demand for transparency,

- need for measuring effectiveness and impact.

The image symbolizes the power of transparency.

- Possible challenges and ways to overcome them 4.1 Corruption risks and their prevention:

- risk: creation of fake CSOs,

- solution: introduction of a strict registration and monitoring system.

4.2 Control mechanisms:

- mandatory financial audit for CSOs receiving large sums,

- publication of annual reports,

- introduction of public oversight mechanisms.

4.3 Selection criteria for CSOs:

- clearly defined legal status,

- minimum period of operation (e.g., 2 years),

- proof of public benefit activity.

- Prospects for implementation in Armenia 5.1 Need for legislative changes

- changes in the RA Tax Code,

- additions to laws on non-commercial organizations,

- development of new by-laws.

5.2 Reconciliation of interests of state bodies, CSOs, and citizens:

- creation of a working group,

- organization of public discussions,

- implementation of a pilot program.

5.3 Possible impact on Armenian civil society:

- improvement of CSOs’ financial stability,

- increase in civic activity,

- strengthening of CSO-state cooperation.

5.4 The role of citizens in implementing the mechanism:

- participation in public discussions,

- dissemination of information on social networks,

- support to CSOs through volunteer work.

- Frequently Asked Questions 1. – How does the 1% mechanism work?

- When filling out the annual tax return, the taxpayer indicates the CSO to which they want to direct 1% of their income tax. The tax authority transfers the amount to the specified CSO.

- – Who can use this mechanism?

- All individuals who pay income tax.

- – How are beneficiary CSOs selected?

- CSOs must meet certain criteria (e.g., be registered in a special register, have proof of public benefit activity) and submit an application to participate.

- – How is the use of funds monitored?

- CSOs are required to submit annual reports on the use of funds. CSOs receiving large sums are subject to mandatory audit.

- – What benefits will society gain from this mechanism?

- A stronger and more independent civil society, more effective solution of social problems, development of a culture of philanthropy, increased transparency and accountability of CSOs.

The image symbolizes the path of community development.

- Conclusion 7.1 Summary: The 1% income tax mechanism in Eastern European countries has proven its effectiveness as an innovative tool for CSO financing. It not only contributes to the financial stability of CSOs but also promotes civic participation and increases CSO accountability.

The introduction of this mechanism in Armenia could have a significant positive impact on the development of civil society. However, it requires careful planning, legislative changes, and active participation of all stakeholders.

7.2 Recommendations:

- create a multi-stakeholder working group involving representatives of state bodies, CSOs, international organizations, and experts.

- study the best practices of Eastern European countries and adapt them to the Armenian situation,

- develop a package of legislative changes,

- conduct extensive public discussions,

- implement a pilot program to assess the effectiveness of the mechanism.

7.3 Call to Action Invitation to learn more about the topic We encourage you to learn more about the 1% mechanism. Follow our upcoming articles where we will discuss various aspects of the mechanism in more detail.

Encouragement to participate in public discussions Actively participate in public discussions organized around this topic. Your opinion is important and can contribute to the effective implementation of this mechanism in Armenia.

Together we can create a stronger and more active civil society in Armenia. Your participation can change the rules of the game.

In the next article of the series, we will look in more detail at the experience of implementing the 1% income tax mechanism in the following countries: Hungary, Slovakia, Romania, and Poland. We will present the history of the mechanism’s introduction in these countries, legislative regulations, achievements and difficulties, as well as ways to overcome them.

This article is made possible by the generous support of the American people through the United States Agency for International Development (USAID). The contents are the responsibility of the Armenian Lawyers Association, a subrecipient of Counterpart International, and do not necessarily reflect the views of USAID, the United States Government or Counterpart International.