Inclusion of the principle of income tax equalization on in the draft Tax Code amendment does not issue from the principle of social justice. This is what the experts claim and recommend reviewing the government’s position.

On 5 February, the Human Rights Coalition organised a public discussion on “Challenging of Application of the Principle of Equalization of Income Taxation from the Aspect of Social Rights and Social Justice” within the framework of the EU-funded “Commitment to Constructive Dialogue” Project.

In her welcoming speech, Ms Zhanna Aleksanyan, Chairperson of the Board of the Coalition for Human Rights Protection, noted that despite the preliminary agreement, the representative of the Ministry of Finance does not participate in the discussion. Iin that regard, she expressed hope that the results of the discussion will contribute to changing the course of the process.

Mr. Karen Zadoyan, Karen Zadoyan, the “Commitment to Constructive Dialogue” Project Manager, President of the Armenian Lawyers’ Association project, noted that the draft amendments will directly relate to all employees, businesses and consumers in connection with the proposed changes in income tax and other types of taxes.

“This is a unique meeting, which will outline the position of professional organisations, and the government should take into account this position. I am sorry that the representative of the Ministry of Finance responsible for these changes is not present. We expect the ministry to express its position on why it is absent in this important meeting, which does not issue from the transparent policy adopted by the government,” K. Zadoyan said.

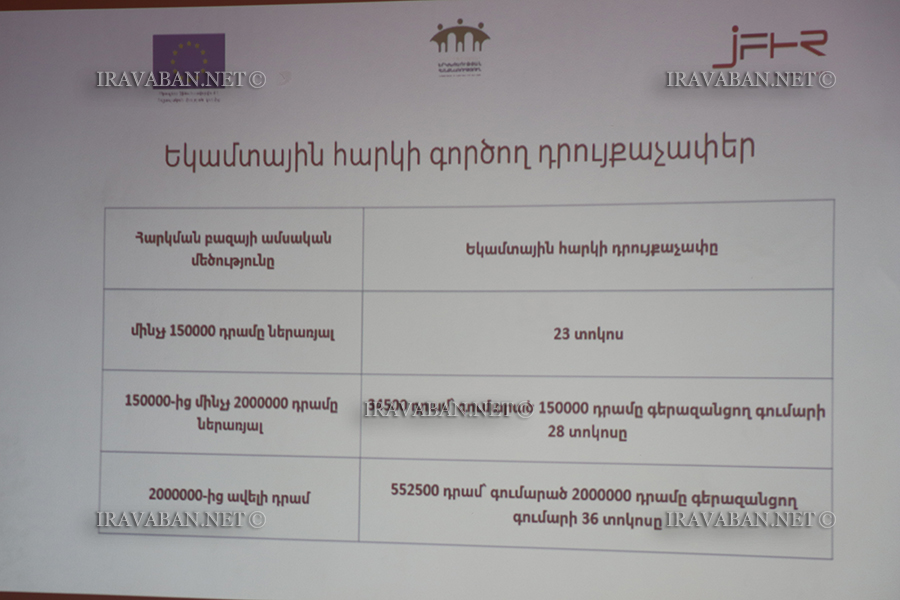

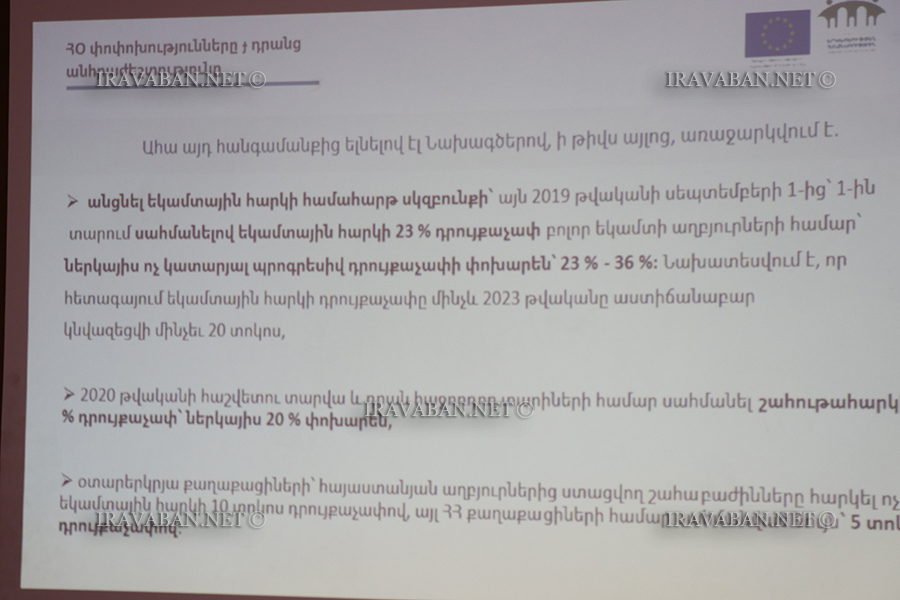

Hovhannes Avetisyan, Public Finance Management Expert, presented the international experience of the principle of financial and social-economic consequences of the income tax equalization. The expert analysis presented by Mr. Avetisyan here.

Mr. Movses Aristakesyan President of the Coalition member “Economic Rights Center” NGO spoke about the disputability of the principle of equalization form the aspect of social rights and social justice.

Mr. Eduard Badalyan, President of the Coalition Member “Citizen, Taxpayer, Business Rights Protection” NGO, presented the problematic aspects of the development of social entrepreneurship and administration issuing from the aspect of application of the principle of income tax equalization.

At the end of the discussion, systematized recommendations were presented to the professional audience, new views and suggestions were presented, which after summarizing will be presented to the Government.

Notably, as a result of the discussion, the participants came to the conclusion that, considering the expert analysis, the government should refrain to apply the principle of principle of income tax equalization.

The “Commitment to Constructive Dialogue” project is implemented with the financial support of the European Union by a Consortium of civil society organisations, which are the Armenian Lawyers’ Association (lead organisation), Agora Central Europe (NGO based in the Czech Republic), the Armenian Centre for Democratic Education-CIVITAS, the International Centre for Human Development, the SME Cooperation Association and the Union of Communities of Armenia.

The project aims to enhance the influence of civil society organisations (CSOs) and CSO coalitions/networks on public policies in Armenia. This will allow organisations that are already working in sectoral coalitions to access additional resources, new groups of civil society experts to come together and encourage place their causes on the local and national policy agenda, to identify common concerns and priorities and approach government bodies with constructive and strategic policy engagement initiatives.

The project has provided sub-grants to CSOs and CSO coalitions that will be directed to the development of public policies and will have tangible results in the 9 target sectors selected within the project, which are: Justice, Human Rights, Public Finance Management, Business, Education, Social Sector (social inclusion of children with disabilities), Agriculture, Economy and Energy.