Eligible participants of the “My Armenia, My Future” contest are all students who are holders of Ameriabank Visa Student card, except those who have already received a scholarship or another award under the previous edition of the contest.

Winners will be selected based on the combination of the following two criteria:

- Cumulative grade point average (GPA) as of the end of the 1st semester of the academic year 2025-2026

- Automated IQ test results

The deadline for submitting applications for participation in the “My Armenia, My Future” contest is November 15, 2025, 11:59 p.m. Yerevan time. The terms of participation and other details are available here.

Under the 2024-2025 edition of the “My Armenia, My Future” contest 160 students from 15 universities of Armenia received scholarships.

The contest is held in cooperation with “reArmenia” charity foundation.

About Ameriabank

Ameriabank is a leading financial and technology company in Armenia, a major contributor to the Armenian economy. In pursuit of digital transformation, the Bank has implemented unique products, services and innovative platforms designed to meet the diverse financial and non-financial needs people have today and keeps on improving them.

Being a dynamically developing fintech environment, Ameriabank offers comprehensive solutions to improve the quality of life.

The Bank is supervised by the Central Bank of Armenia.

]]>Factual Background of the Case

According to the case materials, V. B. was employed at ZCMC on 18.12.2013 under Employment Contract No. 6049. During the course of employment, several amendments were made to the contract, and prior to his dismissal, V. B. held the position of Shift Valve Operator of 4th Grade, Equipment Maintenance of Mechanical Management, Ore Crushing and Conveying Plant.

On 07.02.2025, ZCMC General Director Roman Khudoliy signed an order to terminate V. B.’s employment contract, referring to Article 113(1)(6) of the Labour Code of the Republic of Armenia (loss of trust). The order stated that V. B. had organized and participated in unlawful actions from 31 January to 4 February 2025, which obstructed the company’s work process, including setting up barriers and restricting employees’ access, as a result of which the company suffered material damage.

The respondent argued that the claimant was duly notified and required to provide a written explanation regarding the disciplinary violation within one hour, but V. B. failed to submit any explanation.

The claimant, however, insisted that he never received such notification and was on leave from 15 January to 10 March 2025. Moreover, from 5 to 8 February, i.e., at the time the termination order was signed, he was held in detention (places of arrest).

Court’s Analysis and Findings

In considering the case, the Court first examined the relevant provisions of the Civil Procedure Code of the Republic of Armenia and the Labour Code of the Republic of Armenia. Specifically, it noted that under Article 214(2) of the CPC, a court shall in all cases declare an individual act invalid if the employer violated the procedure established by law, another normative act, or an internal legal act of the employer for amending, terminating an employment contract, or imposing disciplinary liability on an employee.

The Court referred to Article 226 of the Labour Code, which provides that prior to applying a disciplinary sanction, the employer must request a written explanation from the employee within a reasonable time. According to the Court, this norm is designed to protect the employee’s right against possible adverse consequences.

After reviewing the evidence, the Court concluded that the employer failed to prove that it had requested a written explanation from the employee before applying the disciplinary measure. Although the respondent submitted the text of a notification, it did not present any evidence that the notification was actually sent to the claimant.

Additionally, the Court took into account that at the time of termination, the claimant was in detention (places of arrest), which was confirmed by a letter from the Investigative Committee of the Republic of Armenia.

Based on these circumstances, the Court held that the order terminating the employment contract must be declared invalid, as the legally prescribed procedure for requesting an employee’s written explanation had been violated.

On Reinstatement

Regarding the issue of reinstatement, the Court considered Article 265(2) of the Labour Code, which states that if it is impossible to restore the previous employment relationship between the employer and the employee, the court may refrain from reinstating the employee and instead award appropriate compensation.

The Court reasoned that this norm aims to balance the rights and interests of both parties and emphasized that the impossibility of reinstatement must be assessed based on the specific factual circumstances of each case.

Referring to the precedential practice of the Cassation Court of the Republic of Armenia, the Court noted that a tense relationship between employer and employee can constitute grounds for recognizing the restoration of employment relations as impossible.

After examining the evidence, the Court found that there was indeed tension between the parties. In particular, it took into account publications on ZCMC’s official Facebook page, where the company described the employees’ actions as “illegal activities and production sabotage.” The Court also noted that the claimant’s posts on social media indicated strained relations between the parties.

Based on these findings, the Court concluded that the degree of tension between the parties made it impossible for the claimant to normally fulfill his job duties, and therefore decided not to reinstate him.

Determination of Compensation

In determining the amount of compensation, the Court was guided by Article 265(2) of the Labour Code, which provides for compensation not less than the average monthly salary and not exceeding twelve times the average salary. The Court noted that the legislator did not specify concrete criteria for determining the amount, leaving it to the court’s discretion.

The Court held that in setting the amount, factors such as the employee’s length of service and the existence or absence of prior disciplinary penalties should be considered. Since the claimant had worked for the company for more than 10 years, and there was no evidence of prior disciplinary sanctions, the Court determined ten times the average salary as fair compensation.

Court Decision

Based on the above, the Court decided to partially satisfy the claim and ruled to:

- Declare Order No. 281-K dated 07.02.2025 of “Zangezur Copper-Molybdenum Combine” CJSC on termination of the employment contract invalid.

- Recover from ZCMC in favor of V. B. compensation for the entire period of forced idleness in the amount of the average salary, and additional compensation equal to ten times the average salary in lieu of reinstatement.

- Consider V. B.’s employment contract terminated as of the date the judgment enters into legal force.

- Recover from ZCMC in favor of the Republic of Armenia a state duty of 20,000 AMD.

Legal Significance

This case is significant for the practical application of labor law, as it addresses several key issues.

First, it underscores the importance of compliance with the legally established procedure for requesting a written explanation from the employee before dismissal. The Court clearly stated that this requirement is mandatory, and failure to comply leads to the invalidity of the individual legal act.

Second, the Court applied Article 265(2) of the Labour Code regarding the non-reinstatement of the employee, considering the existence of tense relations as a sufficient ground for determining the impossibility of restoring employment relations.

Third, the Court outlined the criteria for determining compensation, emphasizing the employee’s length of service and the absence of prior disciplinary sanctions.

Overall, the case demonstrates that even where grounds for dismissal exist, the employer must strictly adhere to the legally established procedures. Non-compliance may result in the court declaring the dismissal order invalid. At the same time, the Court retains discretionary authority to assess whether reinstatement is feasible and, if not, to award appropriate compensation.

Procedure for Appeal

The judgment enters into legal force one month after its publication and may be appealed to the Civil Court of Appeal of the Republic of Armenia within one month of publication. If not executed voluntarily, the judgment shall be enforced by the Compulsory Enforcement Service at the debtor’s expense, Iravaban.net reports.

Main photo: General Director of “Zangezur Copper-Molybdenum Combine” CJSC Roman Khudoliy and the company logo.

]]>

Case Timeline

On October 9, 2023, the Department for the Seizure of Illegally Acquired Property of the Prosecutor General’s Office of the Republic of Armenia filed a lawsuit with the Anti-Corruption Court against Gagik Tsarukyan and others. The lawsuit was accepted for proceedings on October 18 by Judge Lili Drmayan, and on the same day, the court granted a motion to apply provisional measures.

On December 5, 2023, a preliminary hearing was scheduled, and during 2024—on April 15 and July 1—the court, by its decisions, involved third parties in the case, including “Yerevan Ararat Brandy-Wine-Vodka Combine” LLC.

Motion and Accelerated Trial

At the preliminary hearing on June 19, 2025, Gagik Tsarukyan’s representative submitted a motion to apply accelerated trial procedures and to dismiss the lawsuit on the grounds of being manifestly unfounded.

On September 18, 2025, the court partially granted the motion, applying accelerated trial procedures to part of the case. Specifically, the following claims will undergo accelerated trial:

- Four real estate units located on Moskovyan and Tumanyan Streets in Yerevan

- 373,100 shares of “ABOVYAN CHAPICH-1” LLC

- The purchase costs of three vehicles totaling 25,936,701 AMD (2,653,980 AMD, 4,228,961 AMD, and 19,053,760 AMD)

Two Separate Proceedings

On September 18, the court decided to separate the remaining claims into a distinct proceeding. The new case was assigned the number HCD/0241/02/25 and was also assigned to Judge Lili Drmayan.

By the decision of September 25, 2025, the newly created case was accepted for proceedings, and a preliminary hearing was scheduled for October 14.

Involved Parties

Respondents in the case include Gagik Tsarukyan, his family members, and other individuals, including Javahir Tsarukyan (Arakelyan), Nver Tsarukyan, Hovhannes Tsarukyan, Arpi Avetisyan, and others.

Several companies connected to Tsarukyan’s business interests are involved as third parties, including:

- “Yerevan Ararat Brandy-Wine-Vodka Combine” LLC

- “National Olympic Committee of Armenia” NGO

- “Zvartnots Handling” LLC

- “Onira Club” LLC

- Several companies belonging to the “Multi” group

- “Shustov Trading House” LLC

Court hearings for the separated case will be held at the RA Anti-Corruption Court, located at 3/9 Tbilisyan Highway.

]]>With its vision of building an all-encompassing FinTech Hub in Yerevan via its locally and globally connected industry Association platform – FinTech Armenia is working on shaping the Financial Technology sector’s future, covering Payment Systems, Capital Markets, AI for Financial Services, Blockchain & Tokenization, Insurance and Banking transformation – locally, regionally, and worldwide.

Ameriabank reaffirms its commitment to supporting FinTech Armenia in the development of the fintech sector – creating a dynamic platform between the fast-paced fintech sector and the rapidly evolving Banking industry – in Armenia and internationally. The banking firm’s experienced leadership teams will be engaged in key Institutional Working Groups of FinTech Armenia such as Banking Transformation, Startups & Ventures, CBA Sandbox, Education.

Armine Ghazaryam, CPSO and Management Board Member, stated:

“As one of the key drivers of Armenia’s economy, we continue to transform the banking sector by combining financial expertise, cutting-edge technology, and human-centered values. Our collaboration with FinTech Armenia is about forging new partnerships, delivering bold solutions, and advancing our mission to improve lives. Ameria goes beyond being a financial banking institution – it is a fintech space about people. Our story is about shaping a mindset, building a culture, and fostering values. We have never ceased to be an organization that embraces innovation and thrives on challenges. This partnership marks the genuine continuation of our fintech journey, contributing to the sustainable growth of the fintech industry both in Armenia and internationally”.

Stefan Lucas, Founding CEO of FinTech Armenia, added:

“Onboarding Ameriabank to our growing FinTech Armenia Association platform is a game-changer – both for Armenia and for the International FinTech-enabled Banking Transformation industry. Ameriabank’s ecosystem solutions extend beyond banking, serving as an industry platform that connects technology, innovation, and investments. We are confident about Ameriabank’s positive contribution to help drive and further scale the integration of Armenian FinTech market participants into the Global Financial Ecosystem – and vice versa.

About Ameriabank

Ameriabank is a leading financial and technology company in Armenia, a major contributor to the Armenian economy. In pursuit of digital transformation, the Bank has implemented unique products, services and innovative platforms designed to meet the diverse financial and non-financial needs people have today and keeps on improving them.

Being a dynamically developing fintech environment, Ameriabank offers comprehensive solutions to improve the quality of life.

The Bank is supervised by the Central Bank of Armenia.

About FinTech Armenia

FinTech Armenia is the leading FinTech, AI & Banking Hub of the Caucasus – acting as a dynamic industry association platform cross-bridging innovation & driving Financial Technology transformation across the Region and Worldwide.

Through Memberships, Partnerships, R&D Streams, Committees & Institutional Working Groups – FinTech Armenia cross-connects Corporates, Governments, NGOs, Academia, and Startups to Accelerate Transformation of the Financial Services sector – thereby Strengthening & Accelerating the adoption of innovative new Financial Technologies, AI Tools & FinTech Solutions.

Contact: [email protected]

]]>Ameriabank continues to hold its position as the absolute leader in Armenia’s banking sector by car loan portfolio with a market share of about 50% as of June 30, 2025.

In the first eight months of 2025 alone, Ameriabank’s car loan portfolio grew by more than 40% compared to the end of 2024. During the same period, over 30% of these loans were issued online via MyCar.am platform. MyCar.am platform enables visitors to find a car that suits their needs and budget, drawing from the offers by more than 60 partner car dealers, including 30 official representatives in the primary and secondary markets. The platform now also allows individuals to sell their own car after registering online.

With advanced calculators, filters and comparison tools the platform streamlines the search process helping users to save time, assess value for money, and make the best purchase decision.

About Ameriabank

Ameriabank is a leading financial and technology company in Armenia, a major contributor to the Armenian economy. In pursuit of digital transformation, the Bank has implemented unique products, services and innovative platforms designed to meet the diverse financial and non-financial needs people have today, and keeps on improving them.

Being a dynamically developing fintech environment, Ameriabank offers comprehensive solutions to improve the quality of life.

The Bank is supervised by the Central Bank of Armenia.

]]>

In a conversation with Iravaban.net, Natali Sahakyan, Head of the Strategic Planning, Policy Development and Monitoring Department of the Ministry of Internal Affairs, noted that the main objectives of the subdivision are to increase public trust in the ministry and the police, as well as to prevent possible violations of discipline, integrity, and ethics.

“Or the detection of such cases, as well as the elimination of their causes and contributing circumstances. Great attention is paid to the continuous development of the capabilities and skills of the subdivision’s personnel.

Cooperation with other officials related to the field is also emphasized, as well as the development of annual programs, the analysis of which will allow identifying existing problems,” Sahakyan noted.

The official also emphasized the importance of the code of conduct developed for police officers, which is based on the standard code of conduct for public servants.

Changes have also been made to the disciplinary code: “The new code defines disciplinary standards, and the procedure for conducting service investigations has been modernized with the application of digital technologies.”

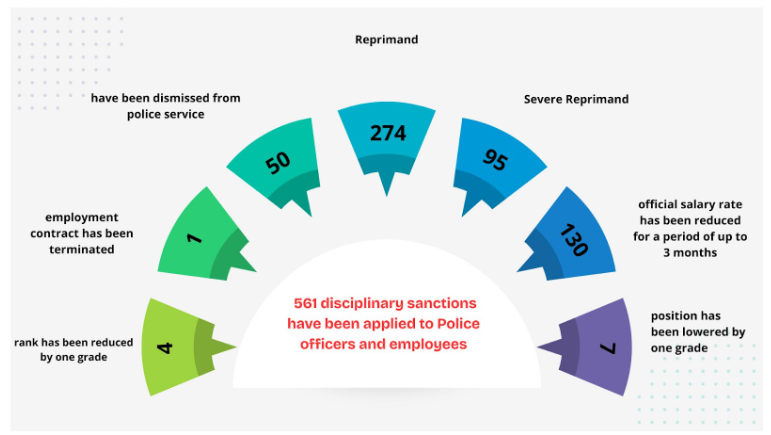

The ministry also reports that during 2024, 1911 service investigations and studies were conducted in the Internal Security and Anti-Corruption Department of the Ministry of Internal Affairs. 53 officers were dismissed, and 46 criminal proceedings were initiated.

At the same time, 21 police officers were dismissed from police service not as a disciplinary sanction, but under Article 45, Part 1, Clauses 9, 9.1, and 11.1 of the “Law on Police Service.”

7 disciplinary sanctions were applied to civil servants of the structural subdivisions of the Ministry of Internal Affairs, in particular: 2 “Warnings” and 5 “Reprimands” were issued.

27 disciplinary sanctions were applied to officers of the Rescue Service, including:

- “Reprimand” was issued to 11

- “Severe Reprimand” was issued to 12

- Basic salary was reduced by up to 20 percent for 2

- Service was terminated for 2

7 disciplinary sanctions were applied to civil servants of the Migration and Citizenship Service, specifically: 3 “Warnings” and 4 “Reprimands” were issued.

30 disciplinary sanctions were applied to employees of organizations under the Ministry of Internal Affairs, in particular: 23 “Reprimands” and 7 “Severe Reprimands” were issued.

During 2024, the Internal Security and Anti-Corruption Department of the Ministry of Internal Affairs prepared and sent materials from 51 service investigations to preliminary investigation bodies, which initiated 46 criminal proceedings (36 regarding police officers, 1 regarding rescue service, 5 regarding migration and citizenship service, 2 regarding structural subdivisions of the Ministry of Internal Affairs, 1 regarding employees of subordinate organizations, 1 regarding citizens).

These contained elements of receiving bribes, abuse or exceeding official powers (including with the use of violence or the threat of using it), official forgery, official negligence, falsification of evidence, explanations or procedural documents, disclosure of information containing state secrets, embezzlement of entrusted property, fraud, theft, extortion, theft of documents, acquisition or sale of criminally obtained property, failure to perform or improper performance of duties for the safekeeping of firearms, weapons, ammunition, abuses in public bidding or procurement, and assistance in illegal border crossing.

During 6 sessions of the disciplinary committee convened at the Ministry of Internal Affairs, 40 materials of service investigations concerning 45 police officers were discussed. As a result of the discussions, by orders of the Minister of Internal Affairs and the Chief of Police-Deputy Minister of Internal Affairs, disciplinary sanctions were applied to 43 police officers, particularly: 3 officers were issued a “Reprimand,” 3 officers a “Severe Reprimand,” and 37 officers were dismissed from police service. In addition, the service investigation against 1 police officer was terminated, and the discussion of the materials of the service investigation conducted against 1 officer and the conclusion drawn up based on its results was postponed.

According to Natali Sahakyan, the ministry will also be consistent in monitoring the behavior of persons dismissed from service to reduce transparency and conflict of interest risks. A study will be conducted on mechanisms for ensuring transparency and mitigating conflict of interest risks during the post-employment period for persons discharged from police service, based on an analysis of international standards (including GRECO) and best practices of at least 5 Council of Europe member states.

A draft of legislative changes will be developed based on the report.

The “Public Oversight and Awareness of Effective and Inclusive Police Reforms” sub-grant is implemented by the “Armenian Lawyers Association” within the framework of the “Monitoring of Justice Sector Reforms in Armenia” program funded by the European Union, under a grant announced by the “Social Justice” NGO.

The project aims to increase civil society participation in monitoring police reforms and assessing their impact by providing structural engagement mechanisms, independent evaluation, and raising public awareness.

This article was prepared with the financial support of the European Union. The “Armenian Lawyers Association” non-governmental organization is responsible for the content, and it does not necessarily reflect the views of the European Union.

]]>Choosing a smart home is not merely about purchasing a few “smart” devices. It is about enhancing quality of life – comfort, security, energy efficiency, and intuitive control. Thanks to LifeSmart, professional solutions that set a new benchmark in the industry are now available in Armenia. And with Smartic’s team providing consultation, design, and installation, the process becomes reliable and high-quality from start to finish.

LifeSmart is a world-class premium brand, often referred to as the “Apple of the smart home industry.” Why?

• It offers exceptional design with intuitive and simple controls.

• The system is built for harmony: all devices work seamlessly together without complex configurations.

• It ensures professional-grade stability and security.

• It is available in more than 100 countries, becoming a trusted choice for millions of users worldwide.

Smartic is the official representative of LifeSmart in Armenia, delivering complete solutions, from consultation to system design, installation, and ongoing maintenance. This means Armenian customers can be assured that they are not simply buying devices but receiving a fully professional end-to-end service.

For those who are not yet familiar with the concept, a smart home is a set of technologies that allows you to control lighting, heating, curtains, security systems, and even household appliances directly from your phone or through voice commands. Everything is managed through a single, unified system.

From now on, subscribers of Team Telecom Armenia, Ucom, and Viva can activate and use imID’s MobileID eSIM service on any eSIM-compatible device—without the need for a physical SIM card. With MobileID eSIM, users can securely and seamlessly register, log in, carry out transactions, and sign documents across banking, government, and private sector websites and applications.

Karen Mkoyan, CEO of imID, highlighted the importance of the initiative:

“Launching Mobile ID for eSIM users is a natural extension of our vision to build an inclusive and modern digital ecosystem. This update marks another step toward innovation, accessibility, and the development of Armenia’s future-ready digital infrastructure.”

The new service offers the same high level of security and legal validity as SIM card–based versions. All identification and e-signature processes are protected with cryptographic technologies that comply with international standards.

About imID

imID is Armenia’s trusted provider of digital identity and trust services, delivering Identification-as-a-Service (IDaaS), Authentication-as-a-Service (AuthaaS), and Signature-as-a-Service (SignaaS) solutions. The company is setting a new standard for digital trust, enabling individuals, businesses, and government institutions to fully engage and participate in the digital world—both in Armenia and beyond.

For more information, visit www.imid.am.

]]>

According to her, it is particularly important that the new police reform strategy for 2024-2026 was developed based on lessons learned from the aforementioned document. Although the previous strategy coincided with a number of problems and obstacles related to the time period, it nevertheless registered great successes in several directions, according to Sahakyan.

“The creation and implementation of the Patrol Service and Operational Management Centers throughout the republic, as well as the establishment of the Ministry of Internal Affairs, were of cornerstone significance. The latter became part of the executive body that exercises civilian oversight and bears political responsibility characteristic of a democratic society.

The clear distribution of functions for policy development and implementation in the field of police activities was very important,” noted Natali Sahakyan.

During the development of the new strategy, observations and proposals presented by state bodies were taken into account, as well as the international obligations assumed by the Republic of Armenia.

“The new strategy has been formed in a fairly comprehensive and, I’m not afraid to say, unprecedented format. The discussions have been quite inclusive: a number of focus group discussions have been organized with the participation of representatives from more than two dozen non-governmental organizations, whose suggestions and observations have also been taken into account,” said Sahakyan.

The Ministry official emphasized that the primary directions of the new strategy are considered to be the final establishment of the Ministry of Internal Affairs, the completion of the structure and functionality of the police, as well as ensuring the continuity of already launched reforms.

The sub-grant “Public Oversight and Awareness of Effective and Inclusive Police Reforms” is implemented by the Armenian Lawyers Association within the framework of the “Monitoring of Justice Sector Reforms in Armenia” program funded by the European Union, under the grant announced by the “Social Justice” NGO.

The aim of the program is to increase civil society participation in monitoring police reforms and impact assessment, ensuring structural engagement mechanisms, independent evaluation, and raising public awareness.

This article has been prepared with the financial support of the European Union. The Armenian Lawyers Association non-governmental organization is responsible for the content, and it doesn’t necessarily express the views of the European Union.

]]>

This innovative solution offers real benefits to clients by reducing costs, accelerating processes, and making them more convenient. Digital cards are complete with all benefits provided by a physical card of the same class, e.g. for a digital Platinum card – free access to DragonPass business lounges worldwide, fast track service at European airports, etc.

It should be noted that the digital business card can be ordered both separately and as part of a package, in which case the client also gets accounts in AMD and foreign currency and Internet Banking/Mobile Banking system for two users.

For more details about digital cards, and for the procedure to apply for them, click here.

About Ameriabank

Ameriabank is a leading financial and technology company in Armenia, a major contributor to the Armenian economy. In pursuit of digital transformation, the Bank has implemented unique products, services and innovative platforms designed to meet the diverse financial and non-financial needs people have today and keeps on improving them.

Being a dynamically developing fintech environment, Ameriabank offers comprehensive solutions to improve the quality of life.

The Bank is supervised by the Central Bank of Armenia.

]]>